WhatsApp)

WhatsApp)

In conclusion, it must be noted that, there is a difference between import duty and other taxes such as VAT, NHIL levy, ECOWAS levy etc and as such while some of the above goods or organizations may be exempted from paying duty it is important to note that other charges like handling fees, VAT, demurrage (if accrued) etc may still be paid.

Income Taxes. Domestic income taxes. Corporate Tax: This is the tax paid by companies on their profits in the year. The tax rate is 25%. Personal Income Tax: Selfemployed persons are required to ...

Dec 03, 2018· Prepared by our Embassies abroad. With its network of 108 offices across the United States and in more than 75 countries, the Commercial Service of the Department of Commerce utilizes its global presence and international marketing expertise to help companies sell their products and services worldwide.

Aug 11, 2007· The import license system was abolished in 1989, but a permit is still required for the import of drugs, communications equipment, mercury, gambling machines, handcuffs, arms and ammunition, and live plants and animals. There are no controls on exports. Ghana .

Special petroleum tax 19 Customs and excise taxes 19 Import duties 19 Special import levy 20 Import duty exemptions 20 ... PAYE tax to the Ghana Revenue Authority (GRA) on or by the 15th day of the month ... Ghana: % and. 2017 Tax facts and figures ...

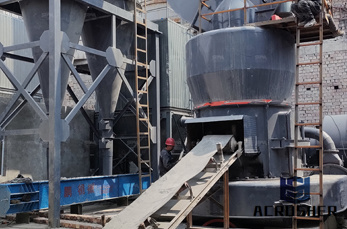

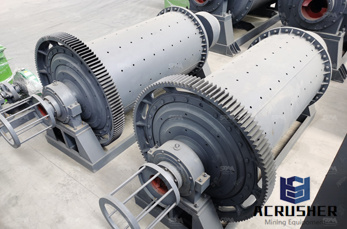

Import Duty Mining Equipment Ghana Prompt : Caesar is a famous mining equipment manufacturer wellknown both at home and abroad, major in producing stone crushing equipment, mineral separation equipment, limestone grinding equipment, etc [Live Online] Mining Equipment Suppliers .

Ghana imports mostly industrial supplies, capital, consumer goods and foodstuffs. ... All other items under the Mining List will attract 5% Import Duty ... reduction in vehicle income tax for ...

thank all tax experts within PKF member firms who gave up their time to contribute the vital information on their country''s taxes that forms the heart of this publication. The PKF Worldwide Tax Guide 2016/17 (WWTG) is an annual publication that provides an overview

Top 5 Products Imported by Ghana. By John. ... Construction equipment, particularly reconditioned equipment, is likely to continue to be a promising subsector. Earthmoving equipment is in demand for use in road construction, mining operations and in commercial/residential property development. ... Ghana Import Duty – The Only Guide You Need.

Home > import duty mining equipment ghana. Ghana Import Duty – The Only Guide You Need Ghana Trade. First, note that goods arriving in the country may be subject to import duty, special duty, VAT and import excise duty. Ghana import duty is assessed based on volume, weight or value of an item, and is subject to change every year.

Ghana mining guide . Executive summary . Ghana presents a number of opportunities in the mining sector, especially in the gold industry. It is the second largest gold producer in Africa, after South Africa and 10th largest globally. The other important mineral resources are oil, diamond, bauxite (used in the manufacturing of aluminum), and ...

African Union import levy 27 Import duty exemptions 27 Administrative charges 27 Export duties 27 Excise duties 27 ... mining, building, construction, farming business or petroleum operations; ... at source and then remits the tax to the Ghana Revenue Authority (GRA) by the

Maple Mining Services (MMS) is an indigenous, heavyduty equipment and mining services company. MMS provides high quality earth moving equipment for rental to the mining, civil and agricultural sectors in Ghana and West Africa. We provide .

LIST OF CONDITIONAL DUTY EXEMPTIONS I FOR INDUSTRY, AGRICULTURE, FISHERIES, FORESTRY AND MINING A Machinery and equipment, including equipment for the transportation of goods, and materials for use in approved industry, and parts thereof, agriculture (including livestock),

UK/ghana double taxation convention155 Кб. the petroleum income tax; (iv) the minerals and mining tax; (hereinafter referred to as " Ghana tax").or equipment where the charges payable for such activities exceed 10 per cent of the free on board salepayable as Ghana tax for any year but for an exemption or reduction of tax granted for that year on...

Inicio>Solución> tax exemption on mining equipment in ghana . La planta de trituracion de arena tph.

Aug 29, 2019· Detailed description of taxes on corporate income in Ghana. A resident person''s worldwide income is assessed for tax. Income from business and investment (from both Ghanaian and foreign sources) is included in determining the resident person''s assessable income.

The levy is collected by the Domestic Tax Revenue Division of the Ghana Revenue Authority through VATregistered persons in the same way that VAT is collected. ... The value for charging VAT on imports is the value for customs duty plus import duties and other taxes which may be chargeable. ... mining (as specified in the mining list) and ...

Import Duty Mining Equipment Ghana Prompt : Caesar is a famous mining equipment manufacturer wellknown both at home and abroad, major in producing stone crushing equipment, mineral separation equipment, limestone grinding equipment, etc.

Dec 03, 2018· Ghana currently uses the Harmonized System (HS) Customs Code to classify goods. Taxes that are assessed on the basis of weight, value or volume are subject to change annually. Goods arriving in the country may be subject to import duty, Value Added Tax (VAT), special tax and import excise duty. Duties are imposed on certain categories of ...

Oct 31, 2019· Ghana is endowed with abundant natural resources, which have played a key role in the development efforts of the country. Ghana has a long history of mining especially for gold. Gold is a precious metal of high monetary value, sought after for the production of coins, jewelry and other artifacts. It ...

PwC Corporate income taxes, mining royalties and other mining taxes—2012 update 3 as "ring fencing". The Ghana government, in the 2012 Budget Statement, proposed an increase to the corporate income tax rate from 25% to 35% and an additional tax of 10% on mining companies. Ghana''s proposed tax increases are likely to take

MINING LIST Exemptions under the Mining List are still restricted to Plant, Machinery and Equipment. All other items under the Mining List will attract 5% Import Duty 6. ECOWAS LEVY (%) An ECOWAS levy of % is levied on all goods and vehicles originating from NonECOWAS Countries 7. Export Development and Investment Fund Levy (EDIF): (%)

Ghana: tax exemptions on import duties — guidelines issued On 13 March 2017, in line with the proposal to require full payments of import duties, taxes and levies, the commissionergeneral (commissioner) of the Ghana Revenue Authority (GRA) issued guidelines on the refund of import duties paid by qualifying applicants.

WhatsApp)

WhatsApp)